Want to Raise? 5 Questions I Ask Every Founder To Assess Their Fundability

Before you pitch, make sure you have the traction, growth, and strategy investors expect.

In this edition

🔹 The #1 mistake founders make when fundraising

🔹 The 5-question fundability test investors use to evaluate you

🔹 How to de-risk your startup before you pitch

🔹 A simple action plan to improve your fundraising readiness

Investors don’t fund stories.

They fund substance.

Clear traction, real demand, and a scalable path forward.

If you can answer these five questions with confidence and data, you’re ready to raise.

If not? Fix first, pitch later.

What Makes a Startup Fundable?

I once worked with a founder who was convinced their startup was ready for a pre-seed.

They had a polished pitch deck, a compelling vision, and a list of investors to reach out to.

But when we pressure-tested their fundability, we realized something:

They were telling a great story, but they weren’t proving it.

No clear problem statement.

No solid traction signals.

No concrete plan for how capital would drive real growth.

Here’s how to know if you’re truly fundable before you start pitching.

Most Founders Pitch Too Soon

The biggest mistake early-stage founders make?

They try to raise before they can demonstrate the value of their startup.

Investors aren’t funding your ambitions. They’re funding a business that:

✅ Solves a painful, high-value problem

✅ Has real traction and demand

✅ Can grow efficiently and scale

✅ Has a strong competitive edge

✅ Knows exactly how investment will drive results

If you can’t prove these, fundraising WILL be an uphill battle.

The 5-Question Fundability Test

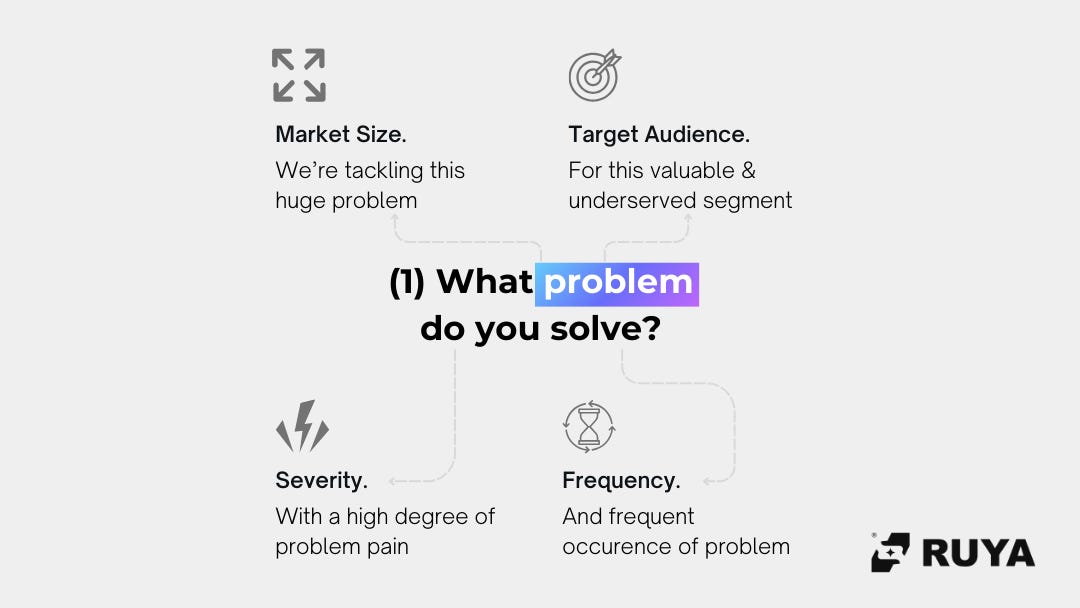

1. What problem do you solve… And is it worth solving?

Investors prefer painkillers, not vitamins.

Your problem should be:

🔹 Severe: Something painful enough that customers will pay to solve it

🔹 Frequent: Happening often enough that a solution is necessary

🔹 Backed by a large market: Investors want big opportunities

If you can prove that customers need this solution, and that enough people need it, you’re already in a stronger position.

You = Great Idea

2. Do you have traction (real signals of demand)?

Saying “people love this” isn’t enough.

You need proof.

Demonstrating REAL demand can put you in a different league compared to other startups vying for the same investors.

And you should do it at ANY stage you’re at.

Pre-revenue? Show proxy KPIs like user engagement, waitlists, LOIs, or early partnerships.

Generating revenue? Investors want to see MRR/ARR, growth trends, retention, and unit economics (CAC, LTV).

Traction turns a “cool idea” into a validated business.

And that’s a solid base for any funding discussion.

You = Great Idea + Validated Demand

3. Can you grow in a scalable way?

A common fundraising killer: you have traction, but no clear path to scale.

Showcase to investors that:

✅ You are only scratching the surface of a big market

✅ You already have great acquisition in place

✅ Your retention and churn metrics are strong

✅ You already figured out repeatable go-to-market motions

Now you’re a growth engine waiting to be fueled.

+ If growth is predictable, you’re fundable.

You = Great Idea + Validated Demand + Ability to Scale

4. What unfair edge do you have?

“Why you?” is just as important as “Why this?”

Your edge comes from two places:

The Team: Deep domain expertise, past wins, key hires.

The Moat: Network effects, proprietary tech, unique data, IP or others.

Unfair advantages make you difficult to copy, and to disrupt.

You = Great Idea + Validated Demand + Ability to Scale + Unfair Advantage

5. Why do you need this money—and what will it do?

If you’ve gotten here. AMAZING.

Now comes your ask. Don’t fumble at this stage.

To have a successful ask, show your investors:

Financial discipline, you have excellent MRR, a reasonable burn rate, a comfortable runway.

A thoughtful valuation, how you arrived at it, and its logic.

Your ask’s rationale, what will you use this money for, with timelines and milestones.

If you can clearly connect capital → growth → milestones, your fundraising ask will be compelling.

You = Great Idea + Validated Demand + Ability to Scale + Unfair Advantage + Will Hit the Ground Running

You are SOLID then my friend.

Try this today

✅ Take 15 minutes and answer these five questions honestly

✅ Identify your weakest link: problem, traction, scalability, edge, or financials

✅ Focus your next 30-60 days on fixing the biggest gap

Which of these 5 questions is your weakest link right now?

Reply and let me know, I might have a framework to help.

Let’s get to work, Majd

More?

Hi, I’m Majd. I help early-stage founders build, go-to-market, and fundraise for their ventures. Here’s how I can support you:

Daily Insights: Follow me on LinkedIn for startup strategies, tips, and real-world tactics

Free Report: Try the Problem-Solution Pulse: get an 11-page personalized breakdown of your startup's foundation.

Advisory Support: Explore Ruya Advisory to see how we can work together 1:1 or through founder programs