How to Talk Equity Between Your Co-Founders (Without Killing the Partnership)

A clear, founder-tested guide to fair splits that keep teams aligned and friendships intact.

In this edition:

🔹 Why equity splitting is NOT a joke (and can bring your startup down)

🔹 5 Factors to consider when deciding “who gets what”

🔹 3 Standard models of equity split for you to think of for your startup

What’s an unnecessary reason for your startup to fail? Founder fallout.

And it CAN happen.

Founders fight all the time. And it’s no surprise, they’re inside a pressure cooker day in and day out, trying to survive.

Imagine them being resentful as well, feeling they are not properly rewarded for their efforts.

Someone can easily walk away then.

That’s why talking about ownership and equity is crucial, at the very start.

Get it wrong, and it can destroy your startup before it even takes off.

Get it right, and you set the foundation for real trust, clarity, and momentum.

Today, I'll show you exactly how to think about it, and avoid the most common traps when thinking of splitting equity.

I had an intro call recently with a pair of founders.

They were all excited about building their business, and launching their amazing solution to the world.

“Have you discussed equity between you two?”

I usually ask this to early founders.

"Yes we’ll just split 50-50 and figure out the details later."

To them it was a no-brainer. We’re friends! We’re excited! We don’t care about money!

But wait 6 months of said “pressure cooker”, and see how you feel then.

Where you’re working HARD day in and day out, while the other person does *in your eyes* nothing.

Equity is a ticking time bomb.

Most founders either:

Split equity equally because they "don't want conflict"

Don’t discuss it and rely on trust without putting clear agreements in place

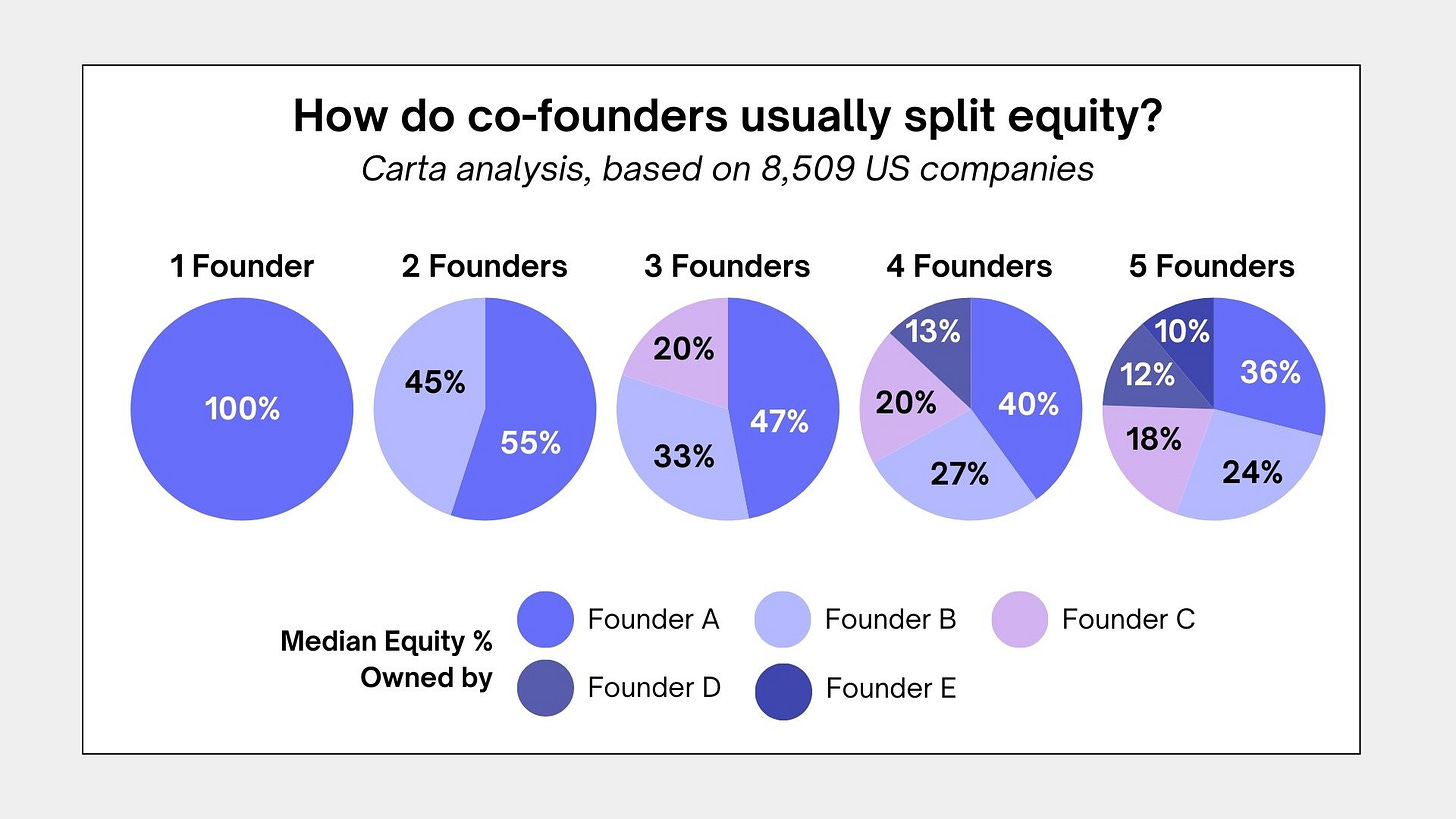

But here’s what the data shows:

More than ANYTHING, make sure you have a clear decision-maker, this matters immensly when things get at a stalemate.

How do I think about my equity split?

After going through it myself, and advising others on this, I can tell you that a smart equity split considers five factors:

Roles and Responsibilities:

What is each person doing? Who’s driving the mission day-to-day? Who is doing strategic work that moves the needle?Commitment Level:

Are you both/all-in full time? or is someone part-time, moonlighting, or halfway in?Experience and Expertise:

Does someone bring unique skills or relationships that give the company a better shot at success?Risk Assumption:

Who’s quitting their job? Who’s risking financial security, reputation, or opportunity cost?Financial Contribution:

Is someone investing cash, or bringing in early resources the company wouldn’t survive without?

When you assess all five factors honestly, you quickly start sketching a fairer picture when it comes to splitting equity between you and your co-founders.

There are three main approaches founders use:

Equal Split:

Simple, but assumes everyone’s contribution and risk is identical. (Rarely true.)Dynamic Split:

Assigns ownership based on clear roles, commitments, risks, and contributions. Harder upfront, but healthier long-term as the startup builds itself.Vesting with a Cliff (highly recommended):

No one "owns" their shares immediately. Instead, ownership vests over 4 years, with a 1-year cliff.

If a founder leaves early, they don’t walk away with a huge chunk of the company.

This structure protects everyone. and keeps incentives aligned.

How do I have an equity conversation with my co-founders?

If you’re about to split equity with a co-founder (or rethink your current structure), here’s your simple checklist:

Frame the conversation right:

This isn’t a negotiation. You are going to work with these people EVERY day. Beyond that one conversation, make sure you’re building the foundation for trust. Your character (and theirs) will reveal its true self then (let’s hope it’s your good side).Don't focus on "getting more":

Don’t come in thinking how can I maximize my gains to the detriment of others. If your co-founder feels shortchanged, they WILL walk away, the startup loses, even if you "win."Document everything:

Don't rely on friendship, trust, or verbal agreements.

Get it written. Get it signed.Use vesting schedules with cliffs:

Protect the business and each other from early exits. The longer you are with us, the more you get rewarded.Talk through the 5 key factors:

Role, commitment, experience, risk, financial input, weigh them honestly.Have a “lead” founder

Remember.

Being fair is NOT the same as being equal.

If you're founding a company right now:

Have you had the real equity conversation with your co-founder, or are you assuming you'll "figure it out later"?

Let’s get to work, Majd

More?

Structure your founder week for peak productivity with this blueprint

Here’s another big mistake you’re making you should avoid ;)

Hi, I’m Majd. I help early-stage founders build, go-to-market, and fundraise for their ventures. Here’s how I can support you:

Daily Insights: Follow me on LinkedIn for startup strategies, tips, and real-world tactics

Free Report: Try the Problem-Solution Pulse: get an 11-page personalized breakdown of your startup's foundation.

Advisory Support: Explore Ruya Advisory to see how we can work together 1:1 or through founder programs

An interesting read! Reminds me of interesting discussion I watched recently where Naval Ravikant advises founders to optimize for control over pretty much everything else.