Build a Pitch That Actually Impresses Investors (Based On 100+ Decks)

Stop overwhelming. Start impressing with this 11-slide structure.

In This Edition:

🔹 Why most startup pitches fail (and how to avoid it)

🔹 The real reason information overload happens in a pitch

🔹 A proven 11-slide pitch deck structure you can steal

🔹 Action steps to sharpen your next investor meeting

I've seen 100+ pitches this past year. Here's what I keep seeing.

I’ve seen these pitches live, in-person, on online calls, in demo days, you name it.

And almost every time, a familiar pattern pops up:

The dreaded information dump.

Founders, DEEP in the weeds of their own startups, try to cram everything they know into the pitch.

The result?

Instead of impressing investors, they overwhelm them.

The Problem? Information Asymmetry

This "overwhelm" isn't because founders are bad at storytelling.

It’s because of information asymmetry.

As founders, we live and breathe our startups. We know the product inside out, the market dynamics, the edge cases. We’re obsessed.

Meanwhile, the investor, sitting across from you, knows nothing.

Instead of meeting them where they are, we feel the urge to bring them up to our level.

We try to transfer months (or years) of knowledge in a few minutes.

That’s a losing game.

A pitch isn't about giving all the information.

It's about giving the minimum viable information that sparks curiosity.

That hopefully gets you to a second meeting.

And then a 3rd.

And then perhaps eventually some $$$.

My 11 Slide Template for a Killer Pitch

After seeing what works (and seeing what flops), I distilled my learnings into the anatomy of a winning pitch.

And packaged it into this simple framework:

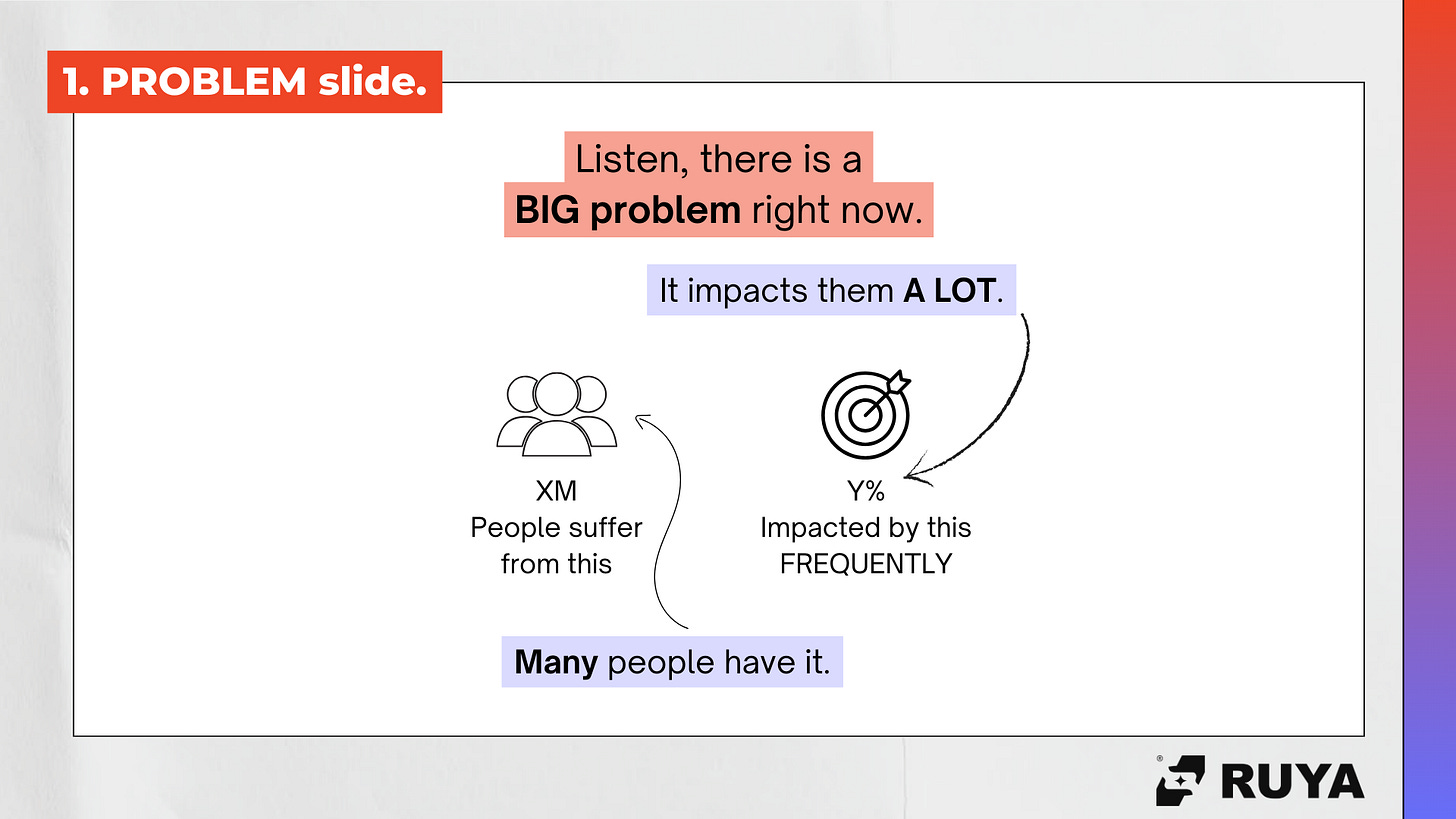

1. Problem Slide

Set the stage.

Describe the pain point clearly.

Make it relatable and urgent.

Help investors feel the problem’s intensity and frequency.

2. Solution Slide

Reveal your solution as an answer to the problem.

How does it uniquely solve the pain point?

Keep it tight, ideally one or two sentences.

Think “elevator pitch”, clear, punchy, memorable.

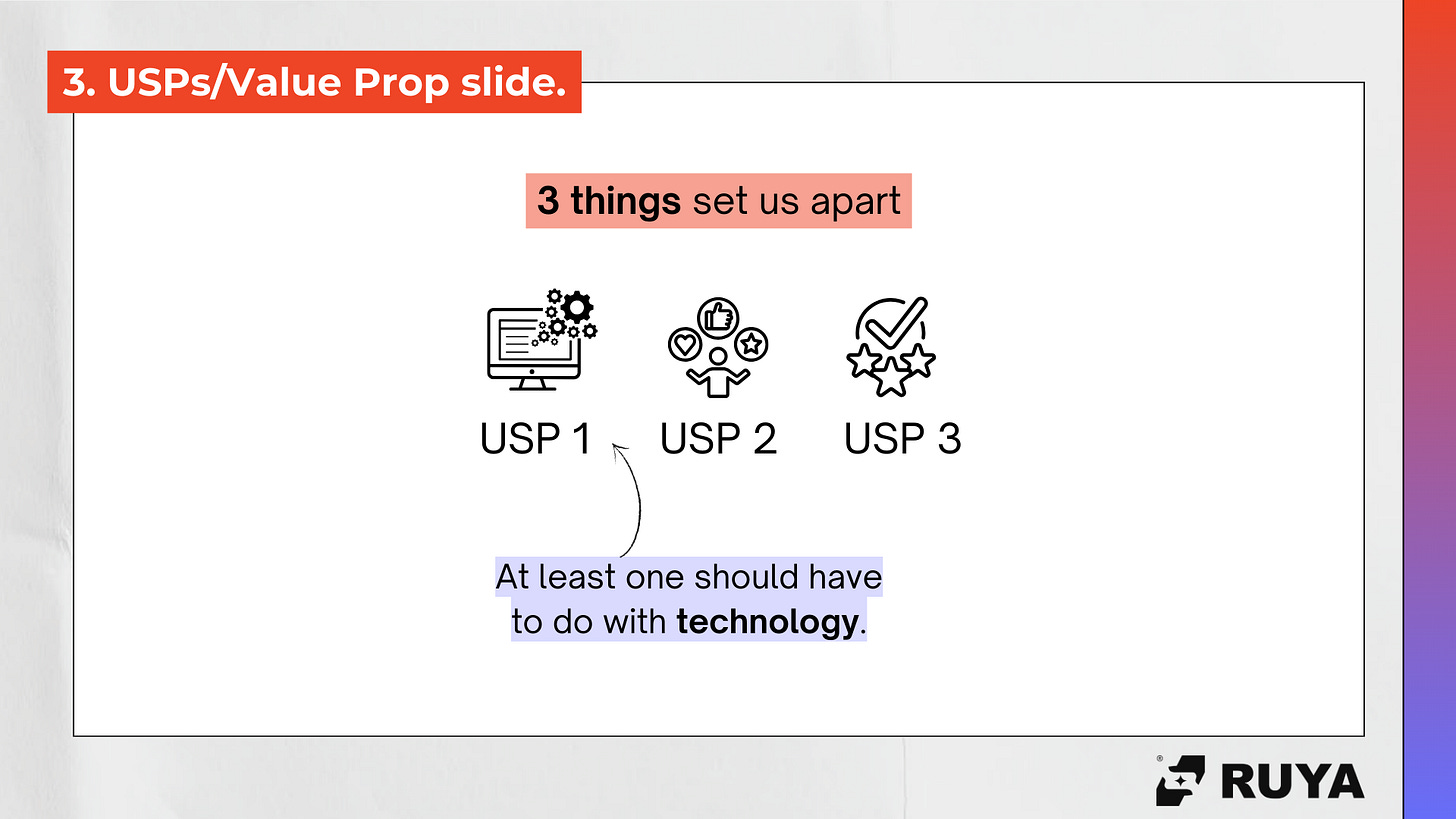

3. Unique Value Proposition (USPs) Slide

Why you? Why now?

Present 2–3 unique advantages you have that make you stand out.

Ideally, one USP should be related to technology (especially for VC pitches).

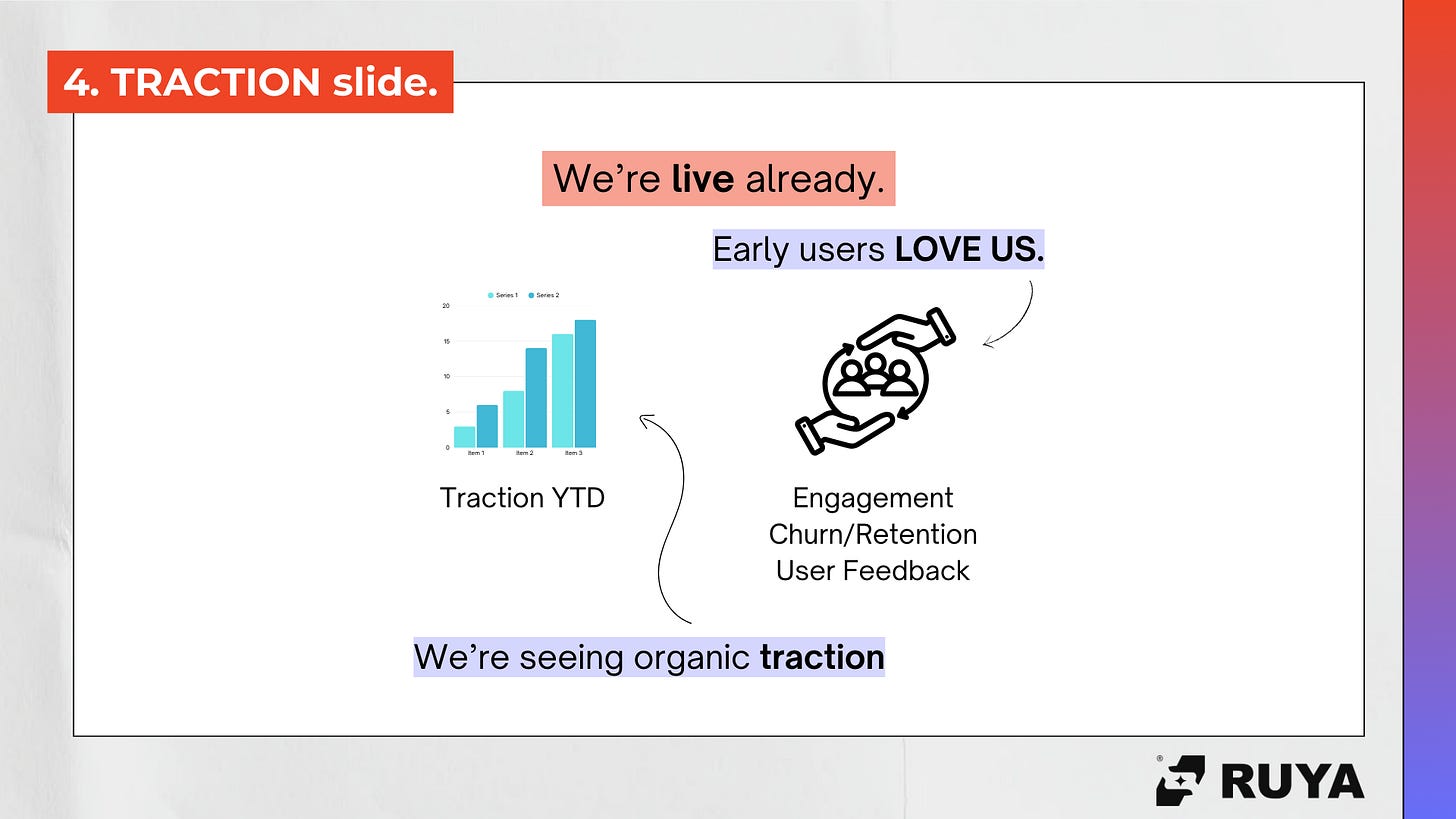

4. Traction Slide

Show proof.

Early users, revenue, engagement metrics, whatever you have.

Prove people want what you’re offering.

Focus on growth signals like retention, organic adoption, repeat usage.

Remember this: Good traction beats a perfect idea. The minute we’re showcasing traction to investors, we’ve elevated the entire conversation to a new level.

Now, we’re now discussing theory anymore. We have tangible proof people actually WANT your product.

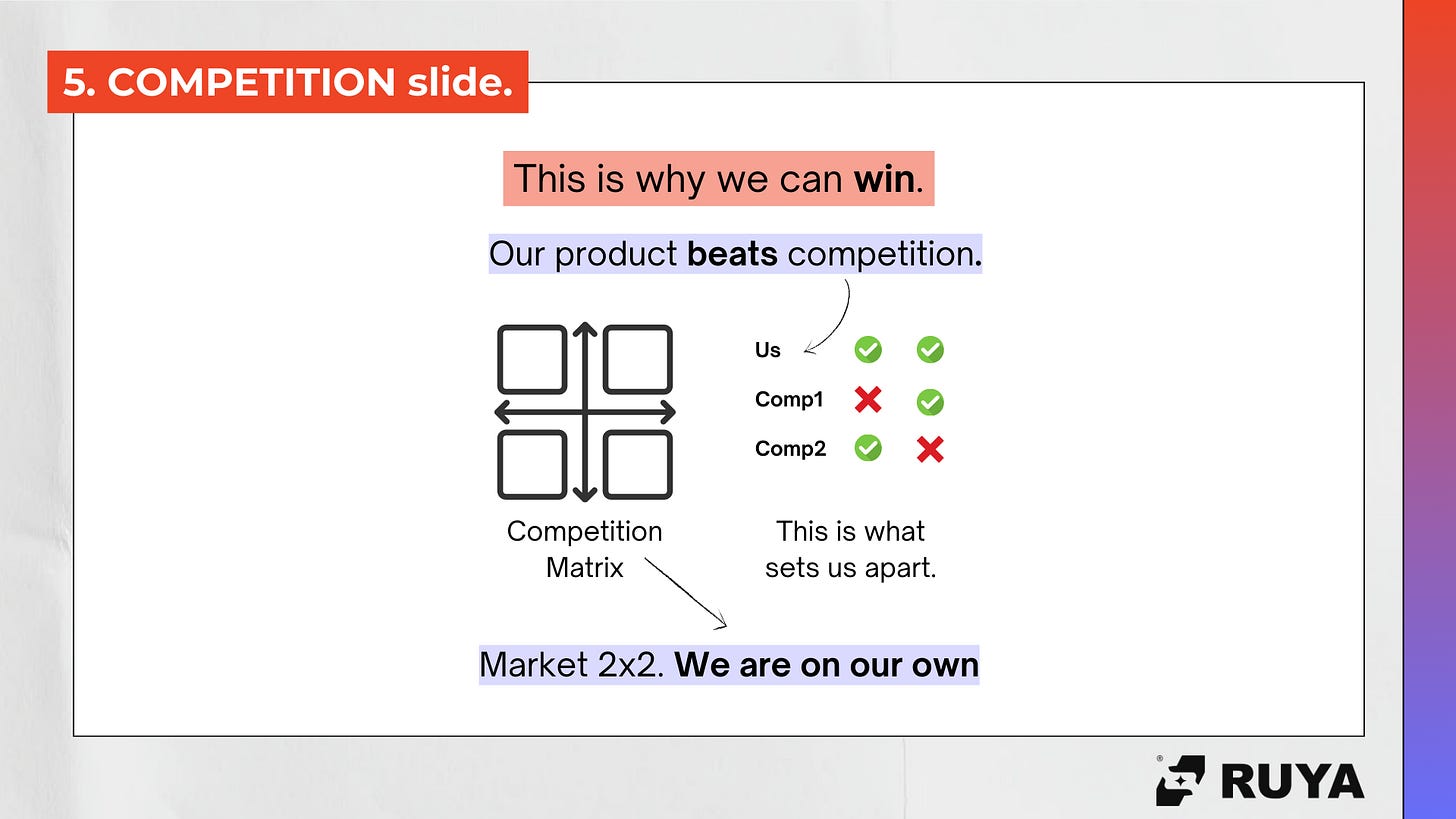

5. Competition Slide

Position yourself smartly.

Who else is solving this problem?

Why are you better or different?

Focus on what truly moves buyers, not superficial feature comparisons.

Hot tip: Remove “we don’t have competition” from your dictionary. Trust me. Don’t go there.

You have competitors, and you should best know them.

6. Market Slide

How big is the opportunity?

Show a healthy Total Addressable Market (TAM).

Make sure your market size numbers are credible.

Highlight trends or tailwinds driving market growth.

You probably want to know, how big should my TAM be?

My answer is, it’s… complicated these days.

Conventional wisdom says that you need to aim for $1Bn+.

Now people are even going as high as $3Bn.

And other are saying too big a TAM is unrealistic.

My advice? Make sure your market is big enough, that you can get a good share from it, and that you stand by your numbers.

And you’ll be fine.

7. Revenue Model Slide

How do you make money?

Explain your business model and pricing approach

Show if you have early revenue traction or a clear path to profitability.

Showcase what upcoming traction you have in pipeline.

8. Ambition (Vision + Projections) Slide

Paint the future.

Where do you see the business in 3–5 years?

What’s the scale you’re aiming for?

Show confidence, but stay grounded in reasonable assumptions.

9. Team Slide

Who’s building this?

Showcase why your team is uniquely suited to win.

Highlight relevant experience, previous successes, or domain expertise.

Especially in your early days, early-stage investors bet heavily on the team.

10. Go-to-Market Strategy Slide

Can you scale? And how will you do that?

What’s your plan to acquire customers systematically?

Mention early successes with acquisition channels if you have them.

If you do a good job here, you’ve basically told investors we’ve cracked a growth engine that’s successful, efficient and repeatable.

All that’s left? Invest in growing faster.

11. The Ask Slide

What do you want?

Clearly state how much you're raising, and what the funds will be used for.

Outline key next steps (e.g., setting a second meeting, due diligence documents ready, etc.).

If you’ve gotten so far, you’ve built amazing momentum.

Don’t fall flat at the finish line. Make sure you drive this home with a clear ask and next steps.

Remember: It’s really, really hard to get an investor meeting.

Don't waste it by overwhelming them.

Show them just enough of what they need.

Use it to open the door to real partnership.

Action Items for Today

Audit your current pitch: Can you tell the full story in just 11 slides?

Optimize your skeleton: What should we add that’s missing? What’s extra that we should remove?

Practice pitching to a "cold" audience: Get feedback from someone who knows nothing about your business.

Cut the clutter: Focus only on what moves the conversation forward.

What's the biggest mistake you’ve seen (or made) in a pitch?

Let’s get to work, Majd

More?

Hi, I’m Majd. I help early-stage founders build, go-to-market, and fundraise for their ventures. Here’s how I can support you:

Daily Insights: Follow me on LinkedIn for startup strategies, tips, and real-world tactics

Free Report: Try the Problem-Solution Pulse: get an 11-page personalized breakdown of your startup's foundation.

Advisory Support: Explore Ruya Advisory to see how we can work together 1:1 or through founder programs

This is super helpful! Restacked :)

Great article! To the point